Introduction

Palantir Technologies Inc. (NYSE: PLTR) is a data analytics company specializing in artificial intelligence and big data solutions for government and commercial sectors. Since its public debut in 2020, PLTR has gained significant investor attention due to its innovative technology and deep ties with government agencies. As the company continues to expand its offerings and customer base, investors are keen to understand the stock’s future trajectory.

Stock forecasting is crucial for investors who want to make informed decisions. By analyzing financial performance, market trends, and external factors, potential investors can determine whether PLTR is a strong buy, hold, or sell. This article provides an in-depth look into Palantir’s business model, historical stock performance, key influencing factors, and future projections.

Company Overview & Business Model

Founded in 2003, pltr stock forecast Palantir Technologies has built a reputation for developing cutting-edge software that enables organizations to analyze massive datasets. The company primarily operates through three major platforms: Palantir Gotham, Palantir Foundry, and Palantir Apollo. Gotham is widely used by government agencies, particularly for defense and intelligence applications, while Foundry serves commercial enterprises in industries like healthcare, finance, and supply chain management. Apollo functions as a cloud-based operating system that integrates and deploys Palantir’s solutions.

Palantir’s unique value proposition lies in its ability to process complex data sets and provide actionable intelligence. This capability has made it an essential partner for the U.S. Department of Defense, law enforcement agencies, and multinational corporations. The company’s revenue model is based on long-term contracts, subscription-based services, and customized solutions. While its reliance on government contracts has raised concerns about diversification, recent expansions into commercial sectors indicate growth potential.

Historical Stock Performance

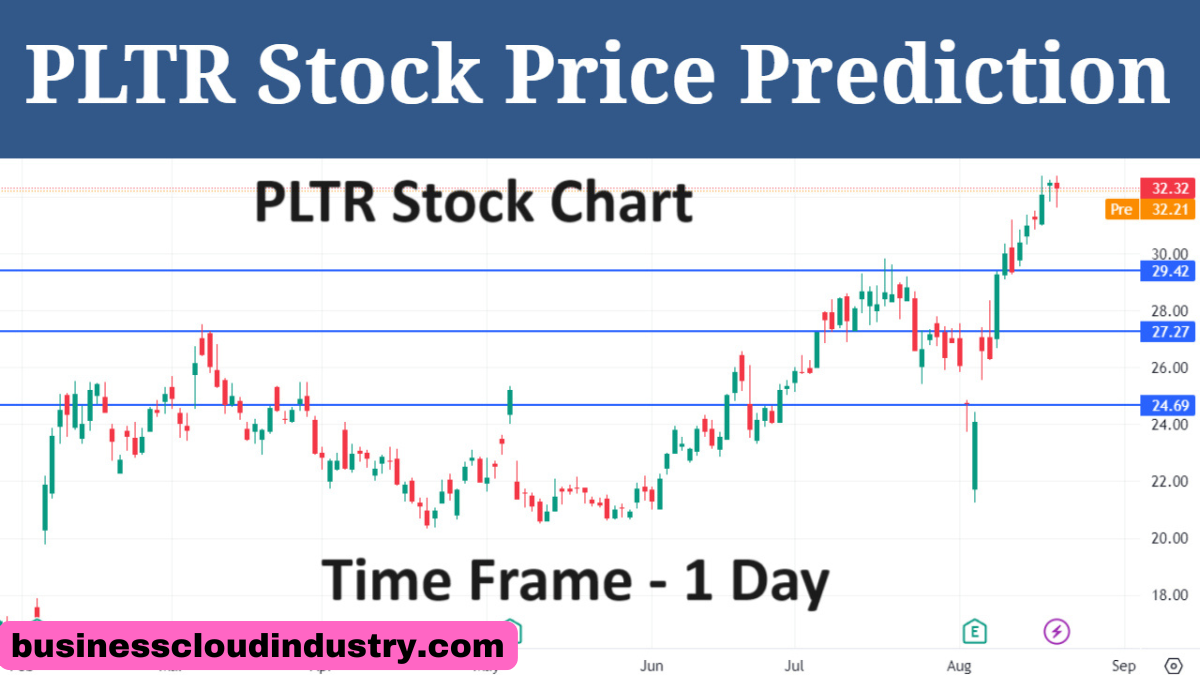

PLTR made its stock market debut through a direct listing on the New York Stock Exchange in September 2020, priced at $10 per share. The stock initially surged, reaching highs of over $45 per share in early 2021, driven by investor enthusiasm for AI-driven analytics and government contracts. However, like many tech stocks, PLTR experienced volatility, with prices declining due to market corrections, inflation fears, and changing investor sentiment.

One of the key factors influencing PLTR’s stock movement has been its earnings reports. The company has consistently shown revenue growth, with annual revenue surpassing $2 billion in 2023. However, profitability remains a concern, as Palantir continues to invest heavily in research and development. Analysts have also noted that stock-based compensation has diluted shareholder value, impacting investor confidence.

When compared to other data analytics and AI-driven companies, Palantir’s stock has demonstrated resilience despite broader tech market fluctuations. Key partnerships, such as collaborations with the U.S. Army and private enterprises like Airbus, have bolstered the stock’s credibility. As the company transitions towards a more diversified client base, its stock performance is expected to stabilize over the long term.

Key Factors Affecting PLTR Stock Forecast

Financial Performance

Palantir has maintained steady revenue growth, with a focus on expanding commercial sector contracts. However, concerns remain over its profitability due to high operating expenses. Investors closely monitor earnings reports, cash flow, and debt levels to gauge financial stability.

Market & Industry Trends

The AI and big data industries are experiencing rapid growth, positioning Palantir as a key player. However, competition from companies like Snowflake, Google Cloud, and IBM poses a challenge. Investors need to assess whether Palantir’s proprietary technology provides a sustainable competitive edge.

Government Contracts & Partnerships

Government contracts are Palantir’s primary revenue driver, but reliance on these contracts can be risky due to regulatory changes and policy shifts. The company’s efforts to expand into commercial markets will be crucial in mitigating these risks.

Investor Sentiment & Institutional Holdings

Institutional investors such as BlackRock and Vanguard hold significant stakes in Palantir. Changes in institutional ownership can impact stock price volatility. Additionally, media coverage and public perception play a role in shaping investor sentiment.

Short-Term vs. Long-Term Forecast

Short-Term Predictions (6-12 months)

In the short term, PLTR’s stock is expected to remain volatile due to market fluctuations and macroeconomic factors like interest rate changes. Analysts predict a price range of $15-$25 per share, depending on earnings performance and contract wins. Investors should be prepared for short-term price swings.

Long-Term Projections (3-5 years and beyond)

Over the next five years, PLTR has the potential to surpass $40 per share, provided it successfully expands its commercial client base and improves profitability. The growing demand for AI-driven analytics presents significant growth opportunities. However, regulatory scrutiny and market competition remain key risks.

Risks & Challenges

While Palantir shows strong growth potential, investors must consider several risks. Market volatility and broader economic downturns could impact stock performance. Additionally, reliance on government contracts means that policy changes could significantly affect revenue streams. Competition from emerging AI firms also poses a long-term threat. Investors should conduct thorough due diligence before investing.

Conclusion

Palantir Technologies is a promising yet volatile stock with significant growth potential in the AI and big data sectors. While short-term fluctuations are expected, long-term investors may benefit from Palantir’s expansion into commercial markets. The company’s ability to diversify its revenue streams and achieve profitability will be critical in determining its future stock performance. Overall, PLTR remains a compelling investment opportunity, but cautious optimism is advised.

FAQs

- Is Palantir a good long-term investment?

- Yes, if the company continues expanding its commercial sector and improves profitability. However, risks remain due to government contract reliance and competition.

- What are the biggest risks of investing in PLTR stock?

- Market volatility, high operational costs, and regulatory uncertainties are major risks.

- How does government reliance affect Palantir’s stock?

- Government contracts provide stable revenue but pose risks if funding decreases or contracts are lost.

- What is the projected stock price for PLTR in the next year?

- Analysts estimate a range of $15-$25, depending on earnings and market conditions.

- How does PLTR compare to its competitors?

- It has strong technology but faces competition from Snowflake, Google Cloud, and IBM.

- What upcoming events could impact PLTR’s stock price?

- Earnings reports, new contract announcements, and economic shifts can influence stock performance.

- What is the analyst consensus on Palantir stock?

- Analysts have mixed opinions, with some predicting long-term growth and others warning about valuation concerns.

- Does Palantir pay dividends?

- No, Palantir reinvests earnings into growth and expansion rather than paying dividends.